vat on dropbox|does dropbox charge vat : Clark Dropbox should supply a VAT invoice with a British VAT number on it. The Irish VAT invoice is incorrect. This would mean that the VAT is payable to the British .

QQ1221 merupakan bandar judi online dengan rtp slot tertinggi dan kami menyediakan RTP Slot secara live sehingga peluang menang semakin besar selain itu kami menyediakan deposit pulsa dan e-wallet. Masuk Daftar. QQ1221 Bocoran RTP Slot Live Gacor Pragmatic Pulsa. Pragmatic Play; PG Soft;

PH0 · vat on dropbox invoices

PH1 · is dropbox vatable uk

PH2 · dropbox vat uk

PH3 · dropbox vat number

PH4 · dropbox uk vat number

PH5 · dropbox reverse charge vat

PH6 · does dropbox charge vat

PH7 · Iba pa

Check out 48 minutes of the greatest highlights/plays/moments in the NBA!Created by GD's Latest Highlights📌 SUBSCRIBE, LIKE & COMMENT for MORE!📌 Check out .

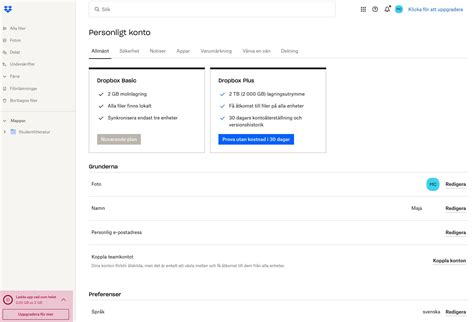

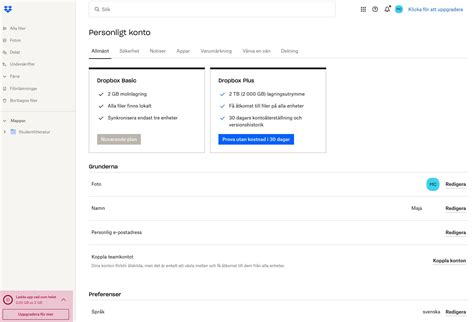

vat on dropbox*******To add a VAT ID or GST ID to your account: Log in to dropbox.com. Click your profile picture or initials in the top right corner. Click Settings. Click the Billing tab. Under Invoice details, click Update. Under VAT number (optional) enter your VAT ID or .

Dropbox Professional et Essentials. Pour ajouter un numéro de TVA ou de GST à .

Some non profit and educational institutions can receive tax exemptions on Dropbox .Do you need to pay VAT or GST on your Dropbox subscription? See how to add . 07-21-2021 04:08 AM. 'That option is only available on Professional and Business accounts.'. NO, Rich, this can't be an 'option'. As soon as the subscriber is EU .

Dropbox should supply a VAT invoice with a British VAT number on it. The Irish VAT invoice is incorrect. This would mean that the VAT is payable to the British .vat on dropbox Dropbox should be submitting VAT returns under the VAT MOSS scheme for customers based in EU countries, which could mean you should be automatically .

Why is VAT charged on foreign country invoices. Labels: Payments and billing. Enid Pretorius. Explorer | Level 4. 04-26-2022 02:54 AM. I am in South Africa but . UK VAT charged but invoice shows Dropbox's Irish VAT number. Labels: Payments and billing. manarh. Explorer | Level 4. 10-31-2022 06:12 AM. UK VAT rules .

How to edit information on a Dropbox invoice. Updated Dec 27, 2023. The information in this article applies to all Dropbox customers paying by credit card, .

Updated Nov 01, 2023. To download a copy of our W-9 form: Click this link to view the form. Click the down arrow (Download) in the top right corner to download it. Was this article . Do you need to pay VAT or GST on your Dropbox subscription? See how to add a VAT or GST identification number to your Dropbox account. View article. Change the currency on your Dropbox subscription. To change the currency for your Dropbox account, you’ll need to cancel your subscription and re-subscribe to Dropbox using your . C ertain types of admins can view your billing history in the admin console for Dropbox Standard, Business, Advanced, and Business Plus teams: Log in to dropbox.com with your admin account. Click Admin console. Click Billing . Click Billing information. You'll see all of the transactions for the team, with the most recent .

Legally, Dropbox must display the same billing information on your invoice that you entered at the time of your purchase. If you’d like to update the billing name, billing address, or VAT ID (future invoices only) on your Dropbox invoice, follow the instructions for your plan below. Dropbox Plus The place of supply of digital services. If you are a business making supplies of digital services to UK consumers, those supplies are liable to UK VAT. If you make supplies of digital services to . Hey @Gianluca-72, thanks for posting to our Community. Since our Plus subscription is a product for personal use rather than a business product, there's no option to add a VAT number on the invoice. However, as a workaround, you can add your VAT number, by editing your account name through your settings here. Hannah. Cesspools, septic tanks or similar (domestic) — emptying. 0%. Emptying industrial cesspools, septic tanks or similar is standard-rated — VAT Notice 701/16. Sewerage services supplied to .Dash isn't just for Dropbox—it works wherever your content lives, so you can search your favorite apps, emails, and much more in seconds. Get Dash beta free. How will you use Dropbox? For work. Work efficiently with teammates and clients, stay in sync on projects, and keep company data safe—all in one place.Address on VAT Registration: 8TH FLOOR, 100 BISHOPSGATE, LONDON, , EC2N 4AG. Period when VAT number issued: Issued after November 2009. Estimated date VAT number issued: December 2013. Last checked by us: 2023-08-29. DROPBOX UK ONLINE.'s VAT Number is GB191774672. Dropbox Professional och Essentials. Så här lägger du till ett momsnummer eller GST-ID på ditt konto: Klicka på din profilbild eller initialer i det övre högra hörnet. Klicka på Inställningar. Klicka på fliken Fakturering . Klicka på Uppdatera under Fakturauppgifter. Under momsnummer (valfritt) anger du ditt momsnummer eller GST-ID .

Login to Dropbox. Bring your photos, docs, and videos anywhere and keep your files safe. Pour ajouter un numéro de TVA ou de GST à votre compte : Connectez-vous à votre compte sur dropbox.com. Cliquez sur votre photo de profil ou sur vos initiales dans l’angle supérieur droit. Cliquez sur Paramètres. Cliquez sur l'onglet Facturation. Dans la section Informations de facturation, cliquez sur Mettre à jour .

Dropbox has an Australian ABN, but the invoices are issued with their UK entity's details and they claim that there is no GST for business customers on their services, only for personal customers. The invoice refers to reverse charge of VAT/GST, but that's only relevant to EU countries. Surely they should be charging GST and issuing compliant .does dropbox charge vatDropbox has an Australian ABN, but the invoices are issued with their UK entity's details and they claim that there is no GST for business customers on their services, only for personal customers. The invoice refers to reverse charge of VAT/GST, but that's only relevant to EU countries. Surely they should be charging GST and issuing compliant . Aby zobaczyć, jaka kwota podatku jest Ci naliczana obecnie: Zaloguj się w witrynie dropbox.com. Kliknij Konsola administratora na pasku bocznym po lewej stronie. Kliknij Płatności. Kliknij kartę Dane rozliczeniowe. Kliknij Faktura obok najnowszej transakcji. Użytkownicy Dropbox Plus, Family, Professional i Essentials.vat on dropbox does dropbox charge vat Click the Folders or Files tab to see shared content by type. Click the Links tab to see files and folders that have been shared with a link. You can create new shared folders by clicking Shared in the left sidebar, then clicking the Create shared folder above the file list. File requests. Manage file requests and check how many submitters have .

2,000 GB of storage. 3,000 GB of storage. Starts from 9,000 GB for the team. Starts from 15,000 GB for the team. Best-in-class sync technology. Easy and secure sharing.

NIF ESPAÑOL DE DROPBOX. JOSE LUIS. Explorer | Level 3. 08-04-2020 01:47 AM. TIENE DROPBOX UN NIF ESPAÑOL PARA LOS SERVICIOS DE ESPAÑA Y ES OPERADOR INTRACOMUNITARIO EN ESPAÑA O FACTURA CON NIF IRLANDES Y LAS FACTURAS NO DEBERIAN LLEVAR IVA. 0 Likes. 11 Replies. 4,068 Views. 0 Me . Jeśli firma jest zarejestrowanym płatnikiem VAT lub GST, możesz w każdej chwili dodać swój numer identyfikacyjny VAT lub GST do konta Dropbox. Jeśli jesteś firmą zwolnioną z podatku VAT lub GST, która omyłkowo zapłaciła podatek VAT lub GST, możesz ubiegać się o odzyskanie ich kwot od władz skarbowych. .

We would like to show you a description here but the site won’t allow us.

vat on dropbox|does dropbox charge vat